The United States has a progressive tax system. That means people with higher taxable incomes are subject to higher tax rates, while people with lower taxable incomes are subject to lower tax rates.

There are seven federal income tax

brackets: 10%, 12%, 22%, 24%, 32%, 35% and 37%.

For tax year 2021, these are the tax rates single taxpayers and married couples filing jointly:

- 37% for incomes over $523,600 ($628,300 for married couples filing jointly).

- 35%, for incomes over $209,425 ($418,850 for married couples filing jointly);

- 32% for incomes over $164,925 ($329,850 for married couples filing jointly);

- 24% for incomes over $86,375 ($172,750 for married couples filing jointly);

- 22% for incomes over $40,525 ($81,050 for married couples filing jointly);

- 12% for incomes over $9,950 ($19,900 for married couples filing jointly).

- The lowest rate is 10% for incomes of single individuals with incomes of $9,950 or less ($19,900 for married

couples filing jointly).

No matter which bracket you’re in, you probably won’t pay that rate on your entire income. There are two reasons:

1. You get to subtract tax deductions to determine your taxable income (that’s why your taxable income usually isn’t the same as your salary or total income).

2. You don’t just multiply your tax bracket by your taxable income. Instead, the government divides your taxable income into chunks and then taxes each chunk at the corresponding rate.

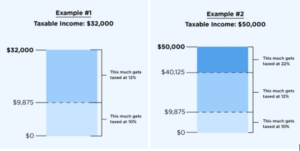

For example, let’s say that for year 2020 you’re a single filer with $32,000 in taxable income. That puts you in the 12% tax bracket in 2020.

But do you pay 12% on all $32,000? No. Actually, you pay only 10% on the first $9,875; you pay 12% on the rest.

If you had $50,000 of taxable income, you’d pay 10% on that first $9,875 and 12% on the chunk of income between $9,876 and $40,125.

And then you’d pay 22% on the rest, because some of your $50,000 of taxable income falls into the 22% tax bracket.

Example for Single Filer in the year 2020